By Jim Heffernan

By Jim Heffernan

I’ve been thinking a lot about a term I’ve encountered recently. The term is “debt peonage” and the writer Thom Hartmann introduced it to me.

Indentured servitude is a form of debt peonage. An indentured servant agrees to work for a certain period of time for their master and at the end of their term they become a freeman. Sometimes they are simply workers and sometimes they are apprentices of a trade.

My first direct ancestor in North America was a man listed as “John Tidd, a servant”. He landed in Charleston, Massachusetts in 1637. Seven years later he was a “selectman” in Exeter, New Hampshire. I suspect he agreed to the servitude to gain passage for the trip to a New World. Nearly half of the Europeans who came here in the 15th. and 16th. centuries came here as indentured servants.

History tells us that the custom started to die out around the time of the American Revolution. In a lot a ways, it did not so much die out as change names. We use names like “tenant farmers”, “sharecroppers” and “contractors” to describe them now. Our history is filled with “company towns” and country music leaves us with the song “Sixteen Tons”* with its mournful chorus, “Saint Peter don’t call me, cuz I cant go. I owe my soul to the company store.”

Its cruelest form was not indentured at all, it was slavery.

I don’t believe it is much of a stretch to also call debt and “employee benefits” a form of indentured servitude or debt peonage.

I’ve never understood the widespread opposition to “Obamacare”. Could it be that the widespread availability of health insurance for everybody might reduce an employer’s hold on us. Maybe the argument isn’t really about insurance at all. Maybe the argument is about being “indentured” by the siren of “employee benefits”. Employers might have to treat their employees differently if they were freer to move about without fear of losing their insurance coverage.

Maybe I’m too quick to see conspiracies, but I’m highly suspicious about the two specters of real estate debt and student debt. I can’t help but think that they are both manipulated. I think partly to keep us distracted, but mainly to transfer a larger and larger share of wealth away from the working and middle classes to the oligarchy in charge.

Google tells me that $2,000 in 1900 increases 2.94% per year. $2000 in 1900 thus becomes $68,666 in 2022.

In Denver, I lived in a fine old Victorian house that cost $2,000 in 1900. I bought the house for $15,000 in 1970. I was delighted to sell the house for $50,000 in 1979. My mortgage was $7,500 when I sold. In 2020, the house sold for $685,000. $550,000 is the outstanding mortgage.

$2,000, in 1900 becomes $15,302 in 1970. Money and house price ($15,000) are tracking pretty close to each other.

$2,000 in 1900 becomes $19,732 in 1979. Money and house price ($50,000) are out of step.

$2000 in 1900 becomes $68,666 in 2022,. Money and house price ($685,000) are way, way out of step.

This progression has obvious winners and losers. Taxes were $30 a month when I left, now they’re $285 a month. House payment was $145 a month when I left, now they’re $3,100 a month. The city and the mortgage holders are big winners. The next generations who looking for a place to live are big, big losers. They are trapped in an everlasting cycle of debt peonage.

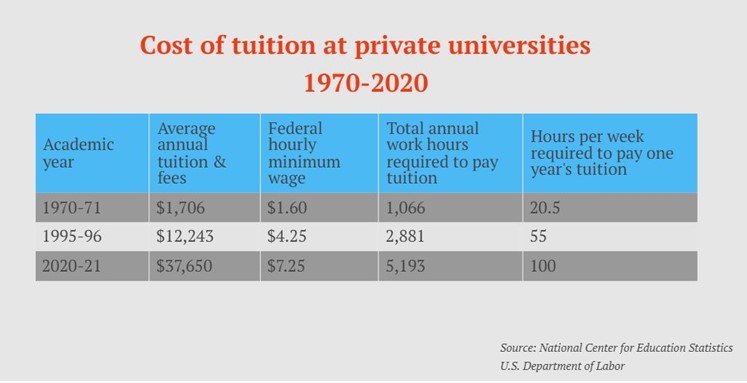

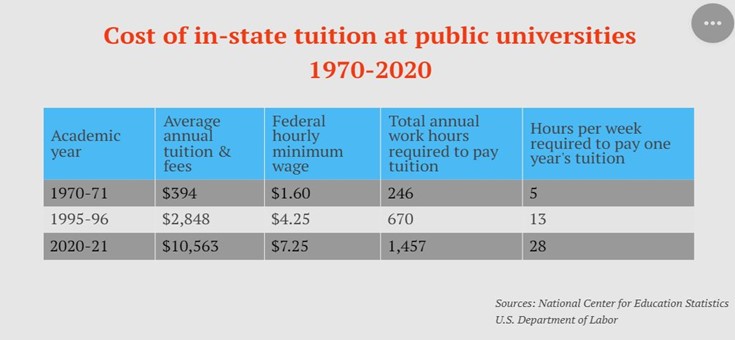

Student debt is another debt peonage trap that has been set for our next generations. Look at the tables below and absorb what the numbers mean. Particularly note how comparatively stagnant the rise in minimum wage has been.

Plain and simple, we’ve invented an entirely new type of debt peonage. 43 million Americans are now carrying student debt because it is no longer possible to finance college through part-time work. To make matters worse, we’ve passed legislation that removes normal consumer protection from student loans.

In my fantasy life, I would jump in with an answer to the problem of debt peonage at this point. In real life, I am flummoxed for an answer.

Debt peonage puts enormous strains on the fabric of our society. It seems to me, that our choices are to find solutions together or wait until the fabric rips apart completely.

As always, I welcome honest, respectful discussion at codger817@gmail.com

* Song was giant hit for Tennessee Ernie Ford in 1955 Here’s a YouTube link https://www.youtube.com/watch?v=3tXJokkWQjY

Sources

Thom Hartmann’s book “The Hidden History of Oligarchy” (2021)

https://www.zillow.com/homedetails/2442-King-St-Denver-CO-80211/13316215_zpid/

https://www.intelligent.com/1970-v-2020-how-working-through-college-has-changed/

(I was very impressed by the intelligent.com web site. It seems a wonderful source for those thinking of college.)