| Once we get through the backlog, I hope to summarize some of the bills advancing to the Senate and some that have come across to the House.

This week, I’d like to focus on a subject that has generated several legislative proposals and is of particular interest and consequence to our coastal economy. That subject is how we collect and use lodging taxes paid by visitors in our hotels and vacation rentals.

Cities and counties in Oregon are eyeing changes to the state’s lodging tax law as a potential fix for funding strains on local services and infrastructure.

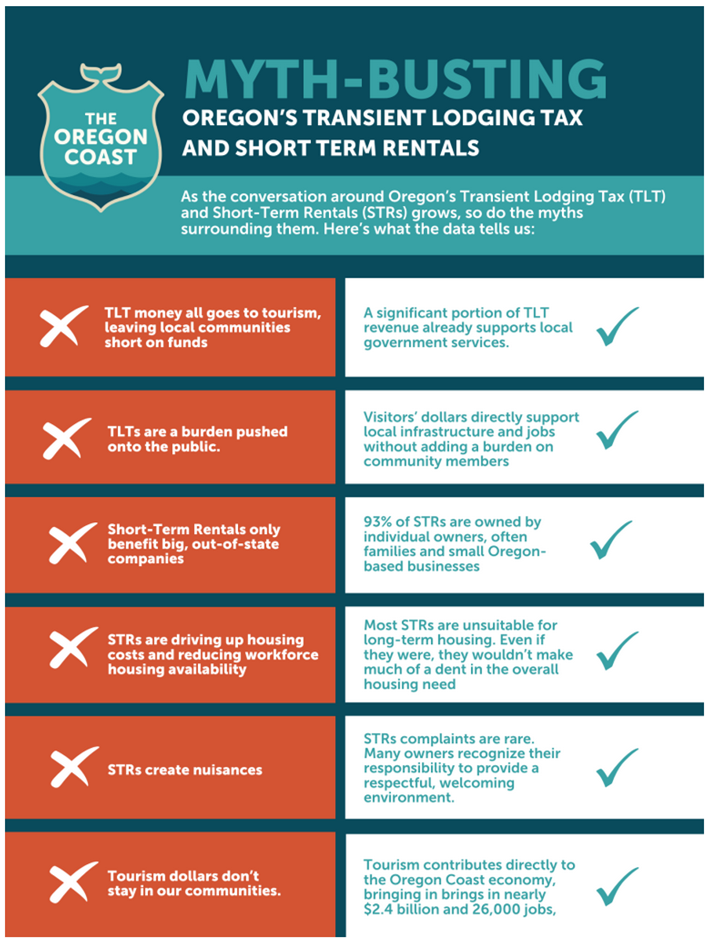

For decades, local governments have collected lodging taxes from hotels, motels, and other short-term lodging providers, and in 2003, the Legislature imposed a statewide tax. The statute also established restrictions around how local lodging tax dollars could be spent, requiring at least 70% to go toward tourism promotion and tourism-related facilities and reserving the remaining 30% for local discretionary spending. The law is meant to support tourism while also putting money back into communities, but many local governments have called out what they see as an imbalance.

- 70 percent must go toward local tourism infrastructure (trails, performing arts and visual art centers, visitor centers, and other venues) as well as tourism marketing.

- 30 percent of all taxes levied after 2003 can go toward the applicable local government’s general fund.

Legislative proposals are suggesting either an adjustment of the 70/30 split with more money available to local governments, or proposing that the 70% be used for tourism infrastructure, promotion, and public safety – the argument being that more people in town place more demands on police and emergency medical support.

Lodging taxes don’t always pencil out to a perfect 70/30 split because the rule only applies to taxes set after the law passed in 2003. Some local governments levied room taxes before then and now have more than 30% going toward the general fund. Lincoln City and Newport, for example, first established their lodging taxes in the 1970s. In Lincoln City, 62% goes directly into the general fund. In Coos Bay, North Bend, and in Yachats, 61% goes to the taxing entity, while just 39% goes to tourism. In Manzanita, 90% is kept for the general fund, with only 10% going to tourism. |