By Representative David Gomberg, House District 10

3/13/2023

Hello Neighbors and Friends,

If your household is anything like the Gomberg household, you are working on your 2022 tax filings.

For the second year in a row, taxpayers will have a few extra days to file their federal income tax returns.

The deadline to submit tax returns for 2022, and pay any taxes owed, will be Tuesday, April 18, 2023. The usual deadline of April 15 falls on a Saturday. When Tax Day falls on a weekend, the IRS traditionally pushes the deadline to the next business day. This year a holiday recognized in Washington, D.C. will push things back a day further to Tuesday.

If you are ahead of schedule, the Oregon Department of Revenue has begun issuing refunds to taxpayers who have filed their 2022 tax returns.

To check the status of a refund, taxpayers can use the Where’s My Refund Tool on Revenue Online. They will need their:

To check the status of a refund, taxpayers can use the Where’s My Refund Tool on Revenue Online. They will need their:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN);

- Filing status; and

- The exact refund amount shown on:

-

- Line 46 of their Form OR-40, or

- Line 71 of their Form OR-40-N, or

- Line 70 of their Form OR-40-P

Here are common reasons refunds may take longer and what to do about it.

- Filing a paper return. Paper returns take longer to process and, as a result, it takes longer to issue related refunds. File electronically instead.

- Filing electronically and requesting to receive a refund via a check takes longer. Request direct deposit instead.

- Filing more than once. Sending a paper return through the mail after e-filing will delay a refund. Taxpayers should file just once.

- Filing during peak filing periods. Refunds are also issued slower during peak filing periods, like the last few weeks before the April 18 deadline. Filing well ahead of the deadline will help taxpayers get their refunds sooner.

- Refunds may be delayed when errors are identified on returns. Taxpayers who receive a letter requesting additional information are urged to respond promptly through Revenue Online to speed the processing of their return.

- Taxpayers who check Where’s My Refund one week after they file and receive a message saying their return is being manually processed should watch their mailbox for correspondence from the department. If it has been 12 weeks or more since they filed their return and they haven’t received a letter from the department, taxpayers should call (503) 378-4988 or (800) 356-4222 to speak with a customer service representative.

Even for many do-it-yourselfers, paying a bundle for tax prep software has become a familiar part of tax season. But filers reporting less than $73,000 in income — a group that includes most Oregonians, as the state’s median household income is just $71,600 — it doesn’t have to be that way. Certain tax prep companies offer free filing as part of an agreement though the IRS. Go to the IRS’s Free File program webpage and navigate to a tax preparer from there.

Oregon’s tax system ranks 24th overall on the 2023 State Business Tax Climate Index. Oregon has a graduated individual income tax, with rates ranging from 4.75 percent to 9.90 percent. There are also jurisdictions that collect local income taxes. Oregon has a 6.60 percent to 7.60 percent corporate income tax rate and levies a gross receipts tax. Oregon does not have a state sales tax and does not levy local sales taxes.

People living near Oregon’s biggest cities earn nearly twice as much as those living in remote, sparsely populated areas. That’s according to a new report from the Oregon Employment Department.

For example, Washington County residents earned $71,500 per capita during 2021. That’s the most of any county in Oregon and well above the statewide personal income level of $62,000 per capita. Contrast that with Malheur County, which had Oregon’s lowest per capita income at $38,900.

You can check an interesting map showing income by county here.

The most recent economic and revenue forecast released last week now projects that Oregon’s unique kicker law will kick by a record amount at the end of the current 2021-23 biennium. The forecast now expects the personal kicker to be $3.9 billion. Remember – this kicker will apply next year when you file your 2023 taxes.

The kicker has been triggered 13 times in the 21 budget periods since it was passed in 1980. It applies when revenues exceed the amount that economists predicted. You aren’t paying more than usual, but more people than expected are paying.

The kicker has been triggered 13 times in the 21 budget periods since it was passed in 1980. It applies when revenues exceed the amount that economists predicted. You aren’t paying more than usual, but more people than expected are paying.

Every taxpayer receives the same credit percentage on their taxes. The more you earn, the larger your kicker will be.

About two-thirds (68%) of this biennium’s $4 billion kicker will be spent on the top 20% of taxpayers, and about a quarter of the funds, close to $1 billion, will go to the top 1% of earners, those earning more than a half million dollars a year. The typical or median-income taxpayer will get about $785, while those in the top 1% will on average get $42,000.

To use even one cent of that critical unanticipated revenue, two-thirds of our state lawmakers in both the House and the Senate must vote to suspend a law. There are some proposals to make changes this year but I don’t anticipate much movement.

The exact kicker amount will be finalized and certified this fall. The kicker will be paid out as a credit on Oregonian tax returns during the spring 2024 tax filing season a year from now.

Oregon tax revenues are reliant on people paying taxes. When we have fewer people, we have less money.

We’ve talked a lot in recent years about how deaths in Oregon now outnumber births and will continue to do so for decades to come. In the chart below you can see how Oregon’s fertility rate has both declined, particularly among younger Oregonians, and also shifted outward a bit, where birthrates are now higher among 30- and 40-somethings than a few decades ago.

Already we are seeing the demographic impacts in the labor force where we know retirements have increased as the Baby Boomers are now mostly in their 60s and increasingly their 70s, and the younger generations are smaller in places like Oregon. For businesses, it will be hard to find workers for the foreseeable future. Additionally, we are also seeing K-12 school enrollment declines. These changes will require a rethink of how we approach growth, our expectations for the future, and the need to adjust public policies.

There has been no bigger economic shift in the past three years than working from home (WFH), primarily for white collar type employees, and the impact on urban cores nationwide.

In 2021, working from home has become more common than it was pre-pandemic. The share of workers that WFH increased from around 6% nationwide in 2019 to 18% in 2021. So while WFH increased, it was and is still a minority of the workforce because most of us need to go into a place of work to cook a meal, give care, or swing a hammer.

At a metro level, Portland’s increases from 2019 to 2021 ranked 11th largest among all metro areas nationwide. Among the Portland suburbs the largest increases were seen in Washington County, then Clark County, followed by Clackamas. The next biggest gains overall were in medium-sized metro areas, and finally rural economies.

At a metro level, Portland’s increases from 2019 to 2021 ranked 11th largest among all metro areas nationwide. Among the Portland suburbs the largest increases were seen in Washington County, then Clark County, followed by Clackamas. The next biggest gains overall were in medium-sized metro areas, and finally rural economies.

This is an opportunity for rural and coastal communities. If wages are currently higher in our cities, and more people work from home, why not work from a home overlooking the ocean, mountains, or a river rather than overlooking your neighbors nearby yard?

Population shifts and declining birth rates will affect our schools. But that doesn’t mean we can spend less on schools. Oregon’s K-12 spending lags behind the national average and well behind neighboring Washington state.

The current Recommended Budget reflects a fairly significant increase in general fund and lottery fund investment, including $9.9 billion for the State School Fund. That marks an overall $600 million increase in K-12 spending for the biennium and would average out to about $9,682 per student in 2023-24 and roughly $10,000 per student in 2024-25, according to preliminary estimates from the Oregon Department of Education.

I understand that some critics might suggest $10.3 billion to be a more palatable number, but please keep in mind that we have limited funds and that this is the starting point for budget negotiations this legislative session and not the final result. Other budgets are being reduced while school spending is increasing.

The state’s per-pupil spending did tick up nearly 3% from the previous year — and Oregon’s per-student spending is expected to rise significantly in the future because schools began receiving money from the state’s 2019 Student Success Act in the 2020-2021 school year. That money is aimed at paying for smaller class sizes, more mental health support in schools, and more help for historically underserved students, including children of color.

As a member of the Ways and Means budget-writing committee, you can be sure that I will be a consistent advocate for increased support for our public education system and increased accountability on how those dollars are sent as the process unfolds.

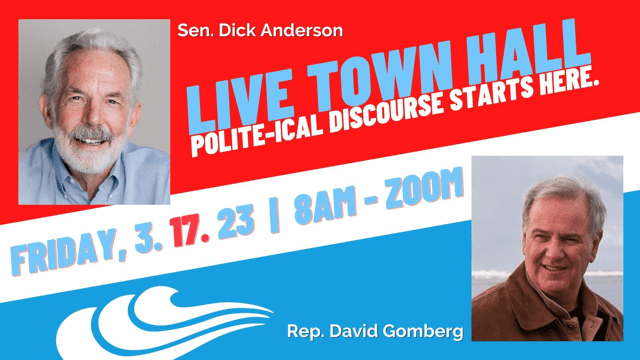

On Friday, March 17, at 8 a.m. I’ll be offering a legislative update together with Senator Dick Anderson. This is a live video Town Hall hosted by Oregon Coast Community College and the Small Business Development Center.

The link to the town hall is https://oregoncoast.zoom.us/j/98576145519, or https://bit.ly/coasttownhall.

Both the Senator and I serve on the Ways & Means Committee, which is scheduled to meet later that morning in Salem. So the Town Hall will end by 9 a.m. If the Ways & Means Committee meeting is canceled on March 17, I’ll plan to attend this forum in person, at Oregon Coast Community College’s North County Center, 3788 SE High School Drive in Lincoln City.

Throughout every full-length legislative term for almost the last decade, we’ve offered these live video conferences in an effort to reach everyone across our large district. Bring your comments and concerns and we’ll hear from as many of you as we can.

email: Rep.DavidGomberg@oregonlegislature.gov

phone: 503-986-1410

address: 900 Court St NE, H-480, Salem, OR, 97301

website: http://www.oregonlegislature.gov/gomberg