It’s an election year – and the primary election is coming up May 21st. There are several important positions on the primary ballot, including several county positions such as for Tillamook County Tax Assessor. Here are the answers from the two candidates for Tax Assessor: KaSandra Larson and Kari Fleisher.

Here again is the link to the AAUW Candidate’s Forum that was held on Sunday April 21st.

KaSandra Larson – County Tax Assessor

1. Why did you decide to run for office?

The core of my campaign centers around my dedication to the people of Tillamook County and the ongoing support for essential services such as schools, public safety, and public health. In Tillamook County, the Assessor also serves as the Tax Collector. This position requires not only technical skills and in-depth departmental knowledge; it also demands a strong commitment and passion for the community. I am a fourth-generation resident of Tillamook County and deeply rooted here. My history in the County is one of dedication and loyalty as I have invested over 21 years with the Assessment & Taxation department. My professional journey started in 2002 at the Assessment & Taxation office, following the completion of my Bachelor of Science in Psychology from the University of Oregon. I became a State of Oregon Registered Appraiser for Tillamook County, focusing on residential appraisal, and progressed to the role of Lead Residential Appraiser & Sales Data Analyst. In 2017, I accepted the position of Chief Deputy Assessor & Tax Collector, not only to enhance my understanding of the tax collection department but for the unique opportunity to serve as the current County Assessor’s Chief Deputy. With a strong foundation in property assessment, tax collection, and staff management, along with six years as the Assessor’s Chief Deputy, I am not only excited but also well-equipped to lead this essential department.

2. What specific goals do you have if you are elected?

The Assessment & Taxation office is preparing for the retirements of Assessor Denise Vandecoevering and our Chief Appraiser Lorrie McKibbin in 2024. I will be working to ensure a smooth transition for the public while maintaining the quality of our services as the department shifts to a new management team. Additionally, I am planning to collaborate with vendors to boost the efficiency of Assessment & Taxation operations through technology. I am presently in discussions with vendors regarding the potential implementation of e-statements by 2025. Furthermore, there will be an emphasis on enhancing the user experience of the department’s website by streamlining the extensive information available. Simplifying the layout and making information easily accessible is essential for meeting the public’s expectations.

3. What is your experience in assessing, preparing, and evaluating public agency budgets?

As Chief Deputy Assessor & Tax Collector I currently work collaboratively with the Assessor to develop and monitor the expenses within the department and have presented the department’s budget to the Board of County Commissioners for the last two years. My extensive service on nonprofit boards such as the Tillamook YMCA, Tillamook Chamber Nonprofit Foundation, and United Way has continued to build my skills in budget management.

4. What is your experience in preparing and evaluating public policy?

Property tax is one of the most impactful public policies around. It plays a crucial role in sustaining our communities by funding vital services such as schools, public safety, and public health, aligning with our community’s priorities. As the Vice Chair of the Association of County Tax Collectors, I collaborate closely with the Oregon Association of County Assessors and Tax Collectors during Oregon Legislative sessions. Engaging with association members, colleagues from various county departments, and community members is essential due to the potential significant impact of new laws on property taxpayers and our community. This year I was involved with SJR 201 AV Exemption Ballot Referral, HB 4141 Reducing Delinquent Interest Rate and HB 4056 Tyler v Hennepin Foreclosure Revenue.

5. Who are your top five campaign finance donors? What is your relationship with them?

This question is interesting as my financial support and endorsements are still ongoing. When this article is released, the top 5 may have shifted. I have been very humbled by the support I have received thus far. My contributions are a mix of friends, family, and professional colleagues. For a complete list of donors please visit State of Oregon: Elections – Candidate Filings and Local Measures. Additionally, I am endorsed by Tim Lutz, former Tillamook County Assessor; Joe Davidson, Lincoln County Assessor; Andy Stevens, Linn County Assessor; Mary Vuksich-Shafer, Lane County Assessor; and Cyrus Javadi, Oregon State Representative for District 32.

6. There are many divisive issues facing our communities, and the divide is becoming greater. How would you bridge these differences and how do you resolve conflicts?

Discovering common ground is one of the most effective tools for bringing people together and resolving conflicts, and property tax can be a challenging topic to unite people on. As a homeowner and property taxpayer, I understand the personal nature of property taxes. I recognize the financial impact it has on someone’s wallet; it can be challenging to make the payment at times. I often speak of how our community’s essential services are partially funded by our public’s hard-earned money. This financial contribution upholds our communities’ common values, helping to ensure stability for our districts. What makes Tillamook County unique is we stand by each other, whether it’s through charity fundraising, aiding nonprofits, responding to natural disasters, or assisting friends in need. Contributing property taxes to local districts is another way we all support the community, and through this contribution, we can find our common ground.

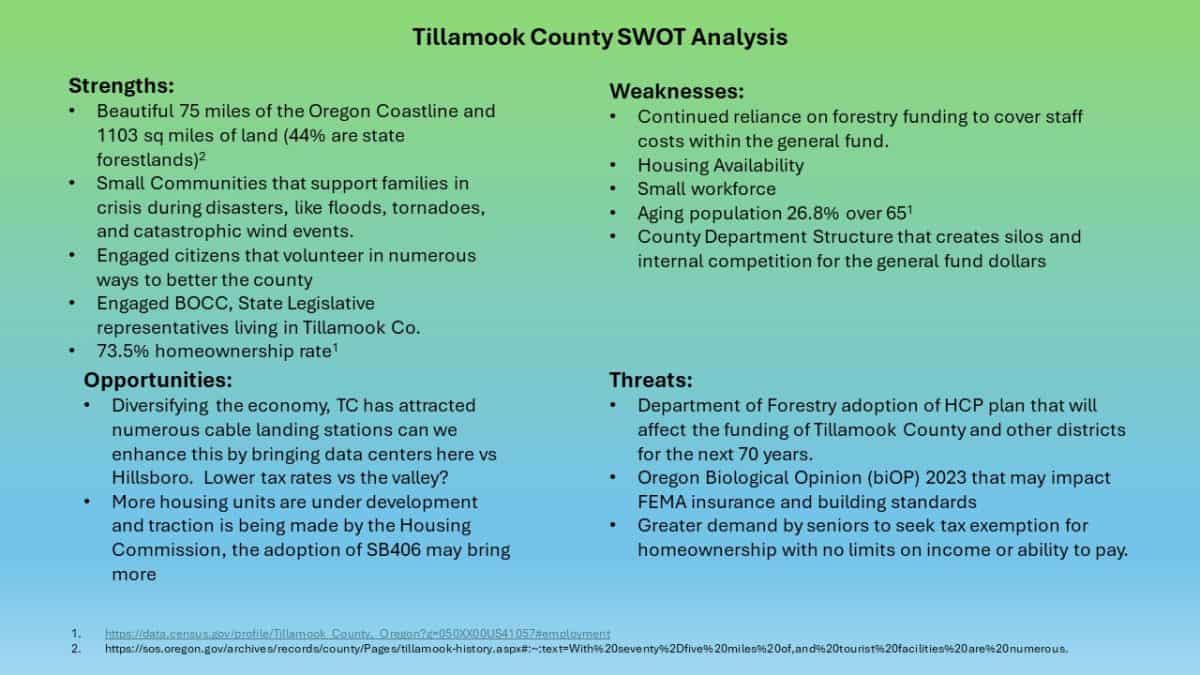

7. Please provide a “SWOT” analysis of Tillamook County – Strengths, Weaknesses, Opportunities, Threats.

The strength of our community is shaped by factors such as trust, inclusivity, active participation, and shared values. We take a tremendous amount of pride in our diverse natural resources and community support. Using the word ‘weakness’ for Tillamook County is not one I am familiar with. While we have areas that require improvement, we identify these areas and collaborate to find common solutions. Our opportunities lie within our tourism and natural resources. Our issues are varied but the topics I currently hear most about are the rate of crime, the Habitat Conservation Plan, homeless population, and the FEMA BiOp. These are all issues that need funding, effective leadership, and legislative changes for effective and positive change.

Kari Fleisher – County Tax Assessor

1. Why did you decide to run for office?

1. Why did you decide to run for office?

I found this a fun and exciting career after starting with the Assessor’s office in 2004. I had the opportunity to get out of the office and appraise various properties, including homes, farms, forestland, sewer and water treatment plants, port properties, commercial, and industrial properties. My best day is working with property owners to answer their questions, no matter how small. I previously ran for Assessor in 2012 when Tim Lutz retired. Before running, I began getting involved with the City of Bay City as a city councilor and the Port of Garibaldi on its budget committee. This way, I could gain a solid understanding of the budgeting process from the beginning. I may not have won that election, but I have been working diligently with the present Assessor, Denise Vandecoevering. I gained numerous responsibilities during this time, taking on the utility roll after the retirement of the prior chief deputy assessor and tax collector. I became the lead appraiser for personal property for business. I also work alongside Denise with value estimates for proposed new taxing districts. With numerous staff turnover due to a lack of housing and retirements, I have taken on the residential areas of Tierra del Mar, Pacific City, Neskowin, and Cascade Head since 2021. This new responsibility has led to being responsible for 25% of the appraisal workload. I have also become involved with the Tillamook County Housing Commission and have been a member since it began in December 2018. In addition, I obtained my MBA degree, enrolling in September 2020 and graduating in December 2021. It required a lot of sleepless nights and long weekends in my home office to complete. With this preparation, when Denise officially stated she was not seeking re-election, it was my opportunity to file and run to be your next Assessor, and I ask for your vote on May 21, 2024.

2. What specific goals do you have if you are elected?

One of my goals is to increase the outreach for business personal property and tax exemptions. Both programs require an application. Each program has precise state laws that determine the timing of filing and taxation and rely on taxpayers to be all-knowing of the rules. It is my goal to provide annual workshops on these topics to provide additional information to business owners, tax professionals, business managers, and non-profits so that they can avoid costly penalties.

Another one of my goals is to use GIS and other data analytic tools to enhance our internal valuation processes and increase efficiency. Addressing questions such as: Is there a particular area or property type that needs reappraisal? I recently found that my home was overvalued by over 20% and had to appeal to the Property Tax Appeal Board with a recent fee appraisal using the appeal rights provided to all taxpayers. All real or personal property must be valued at 100% of their real market value except specially assessed or exempt per state law. There is no guarantee assessed values will be equitable due to our state constitution, amended in 1997. As your next Assessor, I will be prepared to work with future assessment methods and taxation changes as the voters or state legislators pass them.

3. What is your experience in assessing, preparing, and evaluating public agency budgets?

As City Councilor for the City of Bay City, Port of Garibaldi budget committee member, and Zone 3 Director of the NKN School District, I have had numerous opportunities to assess and evaluate the proposed budgets. As a board at the City and NKN, we have developed budget goals on capital expenditures and directed staff to prepare the budget accordingly. I have previously developed internal household budgets for my family and, as AFSCME Union President, which eliminated constant board approval of spending of funds when minor or standard.

On April 1, 2024, I was elected the Neah-Kah-Nie School District budget committee presiding officer. I am excited to share that the proposed $28.8 million budget was unanimously passed by the end of the evening. As your next Assessor, I would prepare a cost-effective budget for the Tax and Assessment departments.

4. What is your experience in preparing and evaluating public policy?

In my experience with the City of Bay City, NKN School District, and the Assessor’s office, I have prepared office policies and approved recommended policies at the district and city levels. At the Assessor’s office, our policies are modeled to comply with state laws and the Oregon Department of Revenue’s Administrative rules. If the policies implemented are unclear or do not fit a circumstance, we have developed office policies to address the issue uniformly. These policies need to be reviewed and modified regularly as laws change. It is my goal to keep policies current and updated as your next Assessor.

5. Who are your top five campaign finance donors? What is your relationship with them?

My top five campaign donors consist of one person, Kari Fleisher. I am self-funding my campaign as your next Assessor. I do not want to be seen as giving preference to any property owner or campaign donor. I hold a high standard of ethics. I was taught a hard lesson several years ago. A local manager once gave me a small salt pouch while appraising their property, as I was pretty interested in their product as a foodie. It would never change my valuation, but my manager considered it an unethical gift. I did reimburse the company for the retail value. Since then, I have been very wary of accepting any “gift” or “donation,” even while campaigning, as I do not want to experience that again.

6. There are many divisive issues facing our communities, and the divide is becoming greater. How would you bridge these differences and how do you resolve conflicts?

I am a genuinely non-partisan candidate. I have been both a Republican and a Democrat, and I have found ideals I liked from both parties. I keep my political beliefs to myself or share only within my household. I have served in numerous non-partisan positions, from the City of Bay City Councilor, AFSCME union president, NKN Board member, and Tillamook County Housing Commission. In each role I was elected or appointed, I looked more at the mission at hand, and my decisions were made based on what was best for the whole, not one group over the other. It may not be the loudest group at the table.

Regarding conflicts, I aim to lead with empathy, listen to taxpayers and their concerns, offer solutions if they can be made within our department, and provide contact information to whom their questions could be sought. In 20 years, I have experienced angry, frustrated taxpayers, but a majority of them will walk away with some more information or their questions answered. I have personally seen a frustrated taxpayer take their complaints forward to the state legislature and get the law changed in the state when our office couldn’t legally provide the solution. I have recommended that a few taxpayers seek legal changes.

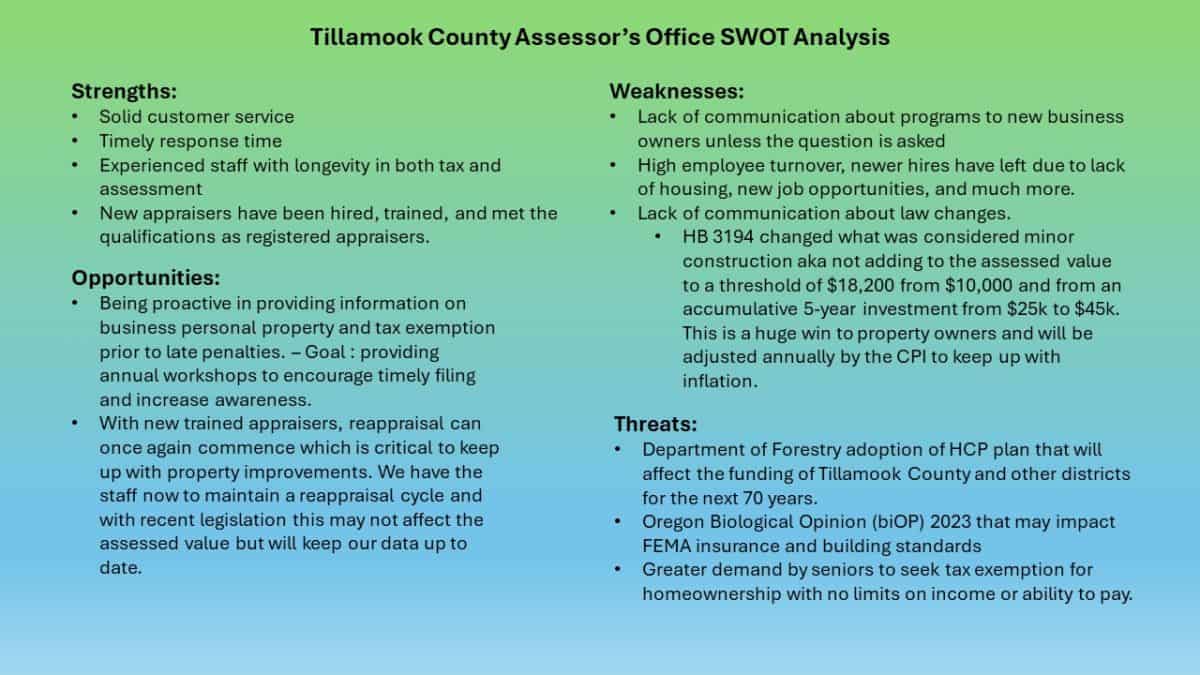

7. Please provide a “SWOT” analysis of Tillamook County – Strengths, Weaknesses, Opportunities, Threats.

See attached images.