Weekly Coronavirus Update: May 1, 2020

By Representative David Gomberg, House District 10

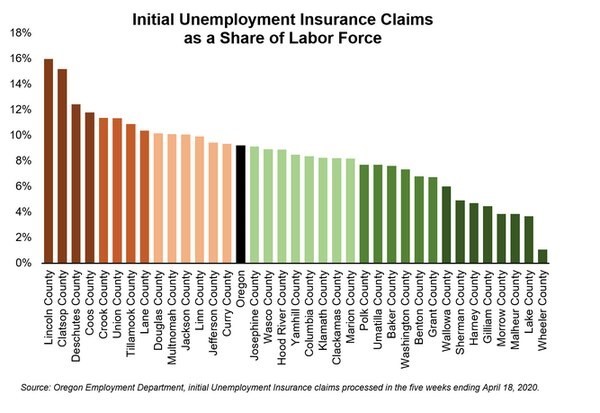

For weeks I have been talking to the Governor’s office and agencies about our situation here in HD 10. The central and north coast currently suffer the highest unemployment rates in the state.

Unemployment by county chart

I’ve been hearing from a lot of people about the trouble they’re having getting their unemployment benefits. The wait times, the unknowns, and the changing answers are incredibly frustrating and need to be fixed completely. Things are getting better, but if you’re someone who hasn’t yet been helped or received your benefits, that’s no consolation.

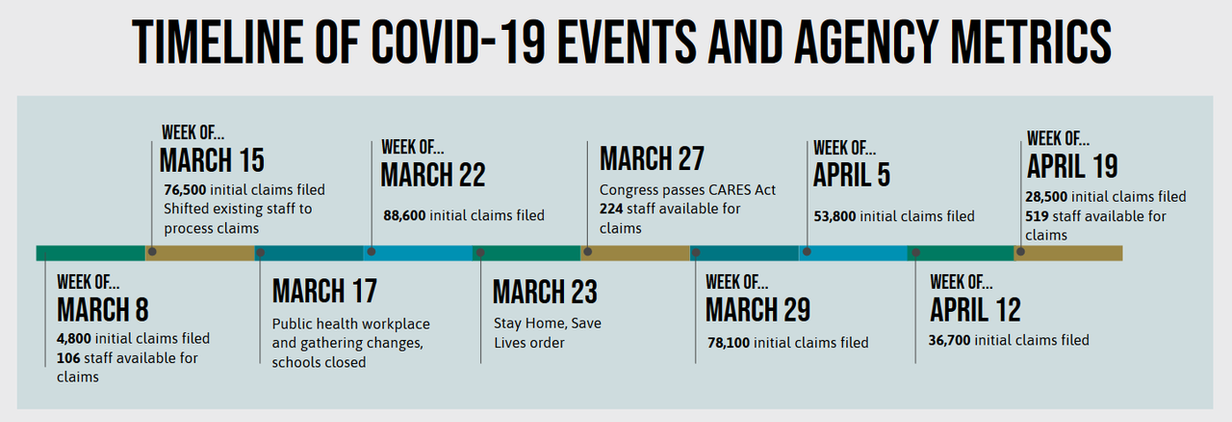

Here’s what we know: The department has processed over 230,000 initial claims over five weeks (not including last week’s numbers). There’s still a long queue of initial claims to process, and many applicants are waiting for one of the new federal programs. Other claims are needing additional attention because the applicant might have a history with unemployment benefits or they need to take extra steps to verify personal information. The department now has more than 600 people working in two shifts seven days a week to process applications. That’s significant considering a month ago there were only 100 claims employees.

Under normal circumstances, it takes three weeks to get a benefit check, but some folks are now looking at four or five weeks for their first payment. The system won’t recognize weekly claims until the initial application is processed, and that’s why people are getting confusing computer messages. When the initial claim is approved, benefits will be retroactive and people will get all the benefits they are owed, including the $600 per week Federal Pandemic Unemployment Compensation.

The email inboxes the department set up for inquiries were overwhelmed, so responses have been taking longer than a week. The department believes that with additional trained staff and new procedures, they are making good progress on the backlog. Email is still the best way to contact the department, since phone call wait times are averaging over 100 minutes. Anyone with claim status questions should reach out to OED_COVID19_info@oregon.gov.

Some people were denied benefits because they said they weren’t looking for work with other employers, which of course makes sense right now. The department made an automatic fix for that. Those claims will be processed, and people should continue filing weekly claims.

If someone was denied because they are self-employed or a 1099 contract worker, the department has been re-programming the claims system to accept those applications as part of the national CARES Act Pandemic Unemployment Assistance program. That includes:

– self-employed

– independent contracts or “gig” workers

– performing work not subject to unemployment insurance tax, such as agricultural workers

– did not earn enough in wages or work enough hours to qualify for regular benefits

– exhausted regular unemployment benefits, and are not eligible for another extension

Workers eligible for PUA and filing for the first time should use the instructions and application on the CARES Act page.

Workers eligible for PUA who have already applied using the online claims system and have an established PIN number should complete the process using the new PUA Application in English or Spanish.

What’s needed for reopening? This Public Health video gives a good overview.

Watch for Signs of COVID-19

With the possibility of more businesses restarting in the coming weeks, I’m hearing from some the concern that workers may not want to return. They may be worried about ongoing health considerations. Or with the added federal $600 a week payment, they may find they make more money staying home.

To be clear – Even though the Employment Department has waived the work search requirement for many claimants out of work due to COVID-19, employees must still remain able and available for work and must also be willing to resume work if called back by their employer. Refusing work could have serious implications for their long-term benefits eligibility.

There are a few rare circumstances related to the pandemic in which a person out of work for that reason could turn down any offered work. Those approved reasons are:

– Being ill with COVID-19.

– Potentially exposed to COVID-19 and subjected to a mandatory quarantine period.

– Staying home to care for a family member, or other person they live with or who they provide care for, who is

suffering from COVID-19 or subject to mandatory quarantine.

– Unable to work because they have to stay home to care for a child due to the closure of schools, child care

providers, or similar facilities due to COVID-19.

– Asked to work when it would require them to act in violation of a mandatory quarantine or government directive.

– Unable to work because they have been advised by their health care provider or by advice issued by public health

officials to self-quarantine due to possible risk of exposure to or spread of COVID-19.

The bottom line and honest assessment is this: The Employment Department is working hard to get applications processed and get people their benefits as soon as they can. And, despite this effort, the wait times are still long and too many people are worried about paying their bills. I will continue to press for better outcomes.

Employment timeline

More Economic Relief Developments

Student Loan Debt: These tips for staying on top of student loan payments come from State Treasurer Tobias Read and Executive Director of the Student Borrower Protection Center (SBPC) Seth Frotman. Watch the recording of their conversation here. And see more in this FAQ from the SBPC.

As of April 10th, automatic payments are not being processed for federal student loans. If you continue to see payments come out, take steps to get help. Contact your student loan provider ASAP or the Attorney General’s office.

If you have federal loans, the government cannot keep or redirect or garnish your CARES Act payment to repay defaulted student loans

If you are graduating from college soon, the SBPC recommends signing up for income-based repayment.

CAT Tax Payments: The Oregon Department of Revenue filed a new rule on Monday to provide additional flexibility for small businesses subject to the corporate activity tax (CAT). The CAT was created in 2019 to support the significant new education investments of the Student Success Act. It applies to businesses with more than $1 million of activity in Oregon.

Under the new rule, businesses subject to the CAT but owing less than $10,000 will not have to make quarterly estimated payments and will not have their CAT payment due until April 30, 2021. The previous threshold was $5,000.

Under the previous threshold, taxable commercial activity of about $1.8 million was not subject to quarterly estimated payment. This rule change raises that threshold to about $2.7 million. Taxable commercial activity is the commercial activity of a business after subtracting the allowable deductions.

Payment Protection Program: Applications reopened Monday for the second round of funding from the Paycheck Protection Program (PPP), designed to help employers keep their employees on the payroll during the COVID-19 crisis. The first round of funding ran out within two weeks and this second round is also expected to go quickly, so get in contact with an approved lender as soon as you can. See approved Oregon lenders here.

If you’re wondering whether your business qualifies or is a good fit for PPP, check with your local Small Business Development Center. Free, confidential advising is available from their staff who have expertise in the details of PPP and other small business relief programs.

Business Oregon’s Small Business Navigator contains the latest information on local, state, and federal aid available to small businesses.

Non-Emergency Medical Procedures Opening: Need surgery? Dental help or an eye appointment? The Governor is restarting non-emergency medical procedures.

Hospitals: https://sharedsystems.dhsoha.state.or.us/DHSForms/Served/le2322u.pdf

Ambulatory surgical centers: https://sharedsystems.dhsoha.state.or.us/DHSForms/Served/le2322t.pdf

Other medical and dental settings: https://sharedsystems.dhsoha.state.or.us/DHSForms/Served/le2322s.pdf

Auto Insurance: Driving Less? The Stay Home, Save Lives order has sharply reduced auto traffic on the roads and with it, the risk of auto accidents. The Department of Consumer & Business Services has been working with several auto insurance companies to secure refunds and credits to auto insurance carriers that reflect the reduced risk of auto liabilities. A list of insurance companies that have committed to providing refunds and credits can be found here.

Our office has been working long days to support the unemployed workers, families, seniors, and small businesses of our district. We’ve also been engaged in regular meetings with leaders from Lincoln, Tillamook, and Yamhill Counties.

Earlier today I took part in a “Coastal Corral” organized by our Chambers of Commerce to discuss the economic environment. A copy of the meeting should be available from your local Chamber.

Things are getting better. Perhaps not as quickly as many might wish, but better nonetheless. And we have avoided potentially devastating rates of illness and fatalities. Let’s stay strong, stay responsible, and stay committed to helping our families, neighbors, and communities.

email: Rep.DavidGomberg@oregonlegislature.gov

phone: 503-986-1410

address: 900 Court St NE, H-471, Salem, OR, 97301

website: http://www.oregonlegislature.gov/gomberg

.png)