by Angelica Ortiz, Career Education Advisor at Tillamook Bay Community College

What I would have liked to know before, about financial wellness is that we must know our values in order to start creating financial wellness based on those values.

Some of the key takeaways were that in order to create financial wellness, we must first understand that thoughts lead to actions, but actions lead to results. Therefore, if we want to create financial wellness, we must have clear goals, create a budget and follow it, since having a budget allows us to see where the money goes. We must also have a financial well-being coach since it is easier to achieve financial well-being if you have someone to guide you.

The strategies I have found most helpful are following the principles that Coach Liz Carrol shared in the financial wellness series. For example, living without debt brings me peace, it’s okay not to have the newest car, and internal dialogue is very important. Following these strategies creates financial well-being, since having no debts allows you to have peace of mind to set new goals and give you more options, for me this is financial wellness. Do not get me wrong, having a debt is not completely bad but it is better to live debt free.

I would recommend the financial wellness series to anyone seeking financial freedom, getting out of debt or improving their lives. The financial wellness Coach Liz Carrol not only teaches strategies about finances, but she teaches principles that apply to daily life.

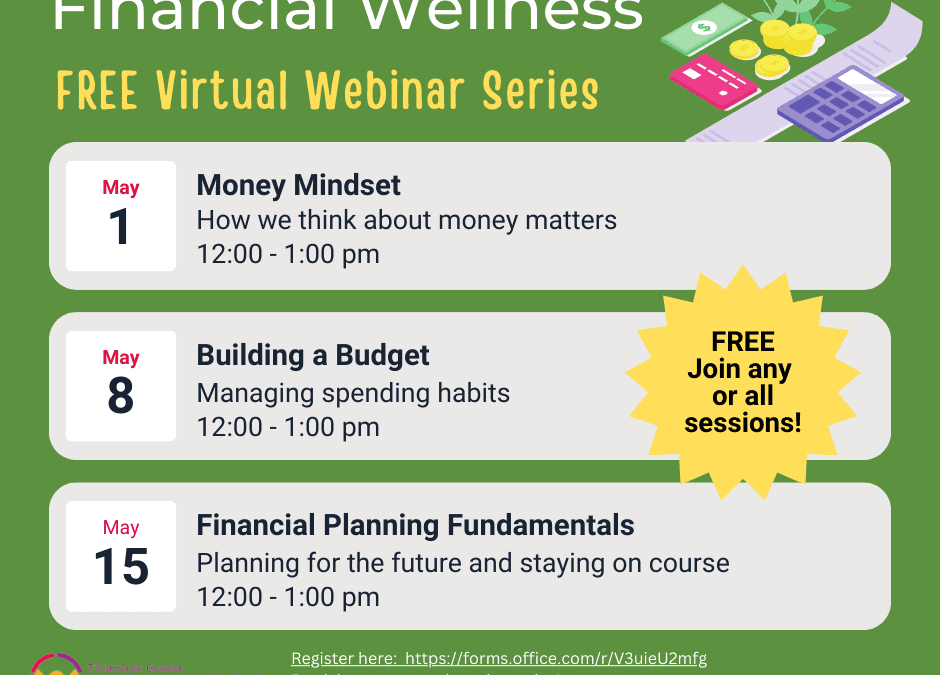

If you missed the initial series, no worries! Liz Carroll will be hosting the series again starting May 1st, each Monday from 12-1 pm through Zoom (click here for registration link). You can attend just one or all four sessions.

Other wellness questions? Email us at info@tillamookcountywellness.org. For more local health and wellness information, visit www.tillamookcountywellness.org or follow Tillamook County Wellness on Facebook and Instagram.